BANKLLECT PLATFORM: decentralized peer-to-peer bank network.

BANKllect is a decentralized peer-to-peer bank network. BANKllect aim to create a unique generation bank ecosystem where each its participant will have a possibility to choose a needed bank service and earn on it. The key difference from currently presented crypto bank solutions (Bankera, Polybius, Datarius, Crypterium, Change, etc.) is that BANKllect proposes a series of bank-focused services in the way different from what the traditional banks do.

At the heart of BANKllect network is a participant. The participant is an individual or company with or without initial financial capital (fiat money, coins, tokens). Our own technology «Proof of Participation (PoP)» allows the participants to earn money by a degree of its activity in BANKllect network.

BANKllect is a decentralized shared bank organize. Its primary assignment is to make an exceptional and new age bank environment where every it member will have a probability to pick a required bank benefit and win on it. The key distinction from as of now displayed crypto bank arrangements (Bankera, Polybius, Datarius, Crypterium, Change, and so on.) is that BANKllect proposes a progression of bank-centered administrations in the path not quite the same as what the conventional banks do.

At the core of BANKllect arrange is a member. The member is an individual or organization with or without beginning budgetary capital (fiat cash, coins, tokens). Our own innovation «Proof of Participation (PoP)» enables the members to procure cash by a level of its action in BANKllect arrange.

Take out a requirement for social affair a main part of customer archives.

Incredibly widen rundown of bank administrations.

Open an entrance to all customers paying little respect to their level of pay

Customers paying little respect to their level of pay.

Allow their customers to acquire cash.

Show an awesome decision of protection programs.

Show an adaptable program of customer investment funds.

Understand a progressive way to deal with worldwide credit framework.

Vision

With respect to our solid group's sureness there are two principle heading of bank administrations improvement in crypto showcase. The explanation behind this characterization is affected by the way that the lion's share of current bank-situated crypto ventures don't concentrated on strategies for customer coordinated effort which are not quite the same as customary bank techniques.

As opposed to inventive methodologies which crypto market can provide for their clients 99% of activities basically duplicate the conventional bank's usefulness. This sort of undertakings is unequipped for changing and enhancing the worldwide bank framework on account of its underlying responsibility to conventional bank framework through licenses.

Extra Programs Information

The extra projects are particularly intended for a plausibility of its financial specialists to get an entrance to an assortment of BANKllect bank items through a use of circle tokens.

BANKllect SOLUTIONS

Miniaturized scale LOAN SYSTEM (MLS)

MLS is particularly intended for members of BANKllect arrange who, to start with, might want to acquire some cash utilizing own digital currency, second, might want to get some cash for claim needs.

Investment PLATFORM (VCP)

VCP is, above all else, intended for improvement of crypto showcase. VCP interfaces the two sides, investors and experts for a solitary objective - «Creation of Innovative Products in Crypto Market».

PROGRAM OF COLLECTIVE DEPOSIT (PCD)

In contrasted and Program of Individual Deposit, PCD associates at least two members of BANKllect organize to share chances between every member engaged with store contract (keen contract). PCD additionally gives an open door for procuring additional cash through component of all in all aggregated crypto tokens.

PROGRAM OF INDIVIDUAL DEPOSIT (PID)

PID interfaces one single member to another single member of BANKllect arrange to sign a store contract (keen contract).

Arrangement OF ASSET ASSESSMENT (SAA)

SAA is a cutting edge IoT-based approach of evaluations of fiat resources. A protest of the appraisal can be a property of as a person as an organization. The primary objective of SAA is tokenization of the advantages.

MULTICURRENCY EXCHANGE SYSTEM (MES)

MES will let complete a trade from any digital currency that is displayed on crypto trade. The trade should be possible with respect to other digital money as to fiat.

IN DEVELOPMENT

Singular Credit Program

Aggregate Credit Program

Customer Insurance Program (for members of BANKllect arrange)

Cash Exchange System

THREE WHALES OF BANKllect

A. Self-controlled Intellectual System (SIS)

At the core of SIS lies three center standards:

Level with states of coordinated effort between members of BANKllect organize.

Sacredness of member information.

Straightforwardness of member movement.

Sister decides a progression of tenets of member joint effort. Sister gives an exceptional plausibility for members of BANKllect system to themselves build up standards and guidelines amid the way toward marking (tolerating) of a solitary side or multi-side shrewd contract. The members will have the capacity to themselves track and control as the action of BANKllect bank as the execution of savvy contracts.

Hostile to Money Laundering System (AMLS)

At the core of AMLS lies two inventive advancements:

Arrangement of investigation of member movement.

Calculation of cross-referenced recognizable proof.

Arrangement of investigation of member movement depends on a propelled innovation of multilayers Rosenblatt perceptron. It permits not to just recognize coordinate activities of members, for example, cash exchange, charge of member wallet, credit of member wallet, advances of any sort, however circuitous activities, for example, relationship to budgetary bank bargains.

Calculation of cross-referenced ID depends on system of coordinated diagram. The calculation permits to for all intents and purposes distinguish any member with least starting information about his or her movement.

Customer Guard System (CGS)

At the core of CGS lies an adaptable arrangement of customer grouping. The framework permits every member of BANKllect system to choose what sort of his or her own or business data will be open or not. CGS gives a novel plausibility for members of BANKllect system to spare their most essential data in cryptographic BANKllect bank cell. BANKllect bank proposes an official assurance of wellbeing of member cell. In addition, protection of cell passage will be incorporated.

TOKEN SALE AND ICO DETAILS

There are four extra projects for pre-ICO, ICO, SCO and TCO, consciously.

1-2 Days : 10% extra tokens

3-7 Days : 5% extra tokens

8-28 Days : 2.5% extra tokens

Pre-sale bonus program.

Extra proposal.

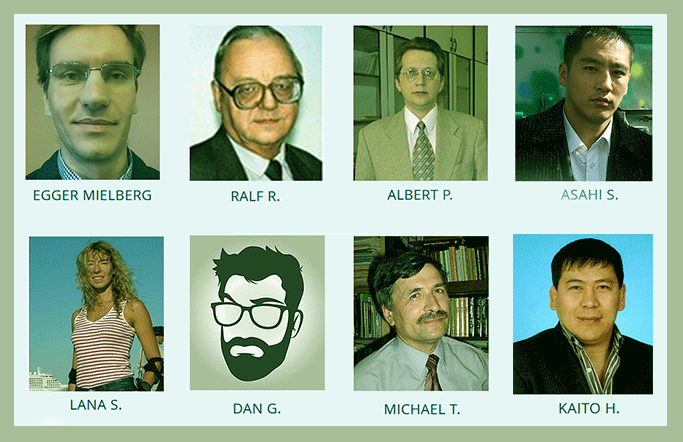

MEET THE KNOWLEDGEABLE TEAM

Kind Regards, ensure to join this incredible project.

FOR MORE DETAILS, CLICK/FOLLOW THE LINKS BELOW:

Website : https://www.bankllect.com/

White Paper : https://docs.wixstatic.com/ugd/570870_6692ff2d06f54b4a8f97439650dca001.pdf

Facebook : https://www.facebook.com/bankllect/?modal=admin_todo_tour

Twitter : https://twitter.com/bankllect

GitHub: https://github.com/BANKllect

Youtube: https://www.youtube.com/watch?v=0ViFqypMEzc&feature=youtu.be

Author: Martilda

Profile link: https://bitcointalk.org/index.php?action=profile;u=1887582

Eth address: 0xd0D5d98857192B3931c831b7B809D47CD830da32